Interest in Zimbabwe’s lithium a timely reminder for robust policies promoting local beneficiation and control.

Last week China’s biggest lithium processor, Zhejiang Huayou acquired controlling rights to Zimbabwe’s Arcadia mine, majority owned by Australian emerging energy minerals company Prospect Resources.

The US $ 422 million lithium deal has attracted significant media attention and mixed public sentiment.

The ensuing polarization pulls back the veil on broader socio economic and political forces at play in natural resource deals in Zimbabwe – a microcosm of the rest of Africa.

Where some sections were upbeat about Zhejiang Huayou’s acquisition as a beacon of progress for Zimbabwe’s economy and a catalyst for jobs and tax revenue for the national fiscus, others were more circumspect.

Sceptics bemoaned what they see as government’s lack of foresight in securing a stake given lithium’s strategic value as the new gold for the auto industry’s burgeoning clean energy market.

Except, there are five other lithium projects – all licensed before the Arcadia one. So, what is so special about Zimbabwe’s latest lithium project?

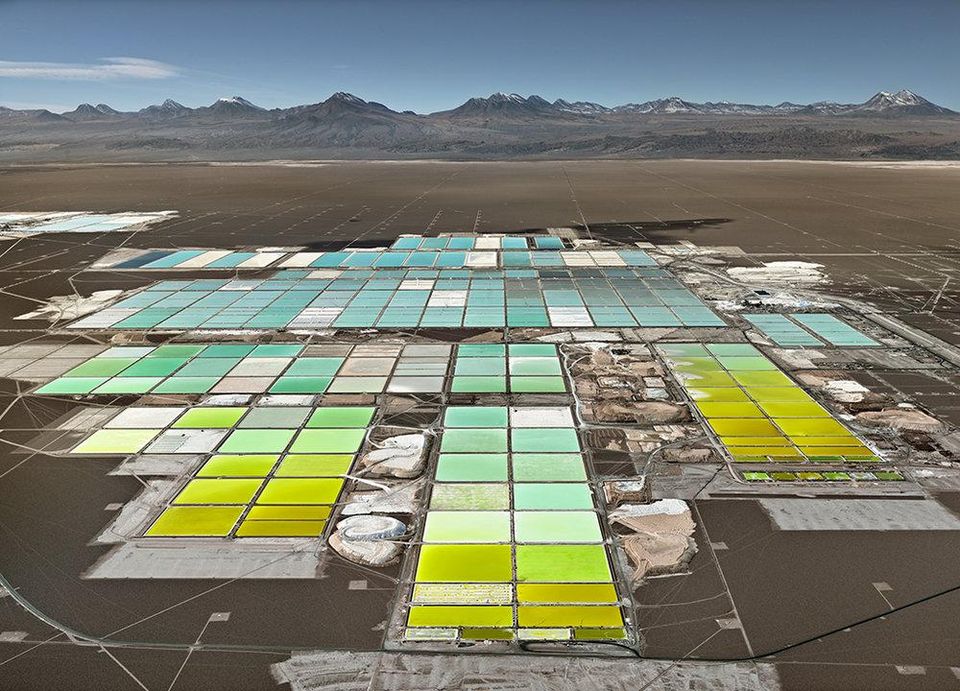

Times are changing. Electric vehicles are about to reach tipping point in penetration, and as a result investment in battery technology and production is rising rapidly.

China is targeting 20% of electric vehicles (EVs) production by 2025. France set a 2040 deadline on all vehicle sales to be EV / hybrid like the UK which is also targeting zero emissions by 2050.

Globally, industry investment in battery production and its value chain is increasing. This is in turn, driving demand for underlying battery raw materials including lithium whose demand has overtaken that of non-battery lithium.

So what’s the missing link? Our past is still present. Zimbabwe still uses an archaic mining law, passed in 1961 to regulate a commodity touted as the next century’s game changer.

The Mines and Minerals Act, which gives the President carte blanche over all mineral resources is woefully inadequate as an arbiter of local ownership and control.

Add to that, the onerous legal requirements for locals to acquire certain mining concessions, which is skewed towards monopoly capital.

It is imperative to look at alternatives sources of financing to circumvent the liquidity challenges affecting the country without sacrificing strategic assets.

Despite past failed attempts arising from inconsistent government policies, the diaspora community is worth another shot.

In 2019, the Reserve Bank of Zimbabwe estimated diaspora remittances at US $ 1, 3 billion with greater upside potential.

A properly structured diaspora offering can entice more localized equity investment and beneficiation as a counterbalance to calls for more foreign direct investment.

We know that the government has the capacity to change the rules. For instance, Prospect Resources was granted national project and special economic zone status amongst other incentives.

So why the lethargy in amending an old statute to empower locals in a legislature run by natives, 43 years after independence?

Many communities have been left counting their losses in the wake of projects hailed as progressive and beneficial for local communities. This is why legislative oversight and robust implementation matters so that there are no gaps in policy provisions.

On the eve of scheduled elections in 2023, Mnangagwa will be looking to shore up support from a lukewarm and restive electorate.

Winning a political mandate is not just about managing perception, delivering tangible results on the ground to positively impact lives and materially change communities for the better would be a good start.

Locals need secure land tenure rights so they can leverage their holdings as substantive equity partners when they tie up with foreign investors instead of always settling for menial jobs.

There is barely enough room to manoeuvre. Resource nationalization is not panacea either, as shown by the many promising projects in limbo.

But past mistakes don’t negate trying other avenues that lock in value for local communities to achieve devolution and create localized economies independent of patronage networks.

Recommendations

Today’s administration should address past omissions and bear the responsibility to ensure that those who lost their lives fighting for generational prosperity did not sacrifice their lives in vain.

Regulatory institutions need to be more vigilant in granting necessary approvals contingent on investors fulfilling certain obligations which further local community interests.

When locals benefit, the local economy flourishes. But when we leave our economy open to the complexity of western economic systems, there is an existential threat to our sovereignty that leaves nursing environmental disaster and empty coffers through transfer pricing and other related financial leveraging instruments.

The consequences of leaving corporations to their own devices are too dire to contemplate. We will need decisive leadership.

Comments

Post a Comment